operating cash flow ratio industry average

To arrive at the operating cash flow margin this number is divided by. Operating Cash Flow Margin Net Income Non-Cash Expenses Amortization and Depreciation Change in Working Capital Sales.

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Ad EY Corporate Finance Consultants Help All Types of Businesses with Key Financial Issues.

. Learn What EY Can Do For Your Corporate Finance Strategy. That is just a smattering of the ROICs across all sectors for giggles the total markets ROIC as of January 2020 is 731 without financials is 1296. For example suppose the ratio is.

Retail Sector faced contraction in cumulative twelve months Free Cash Flow by -87 in 2 Q 2022 year on year. Now let us consider another example. Price To Cash Flow Formula Example Calculate P Cf Ratio Operating Cash Flow Ratio Formula Guide For Financial Analysts.

Cash flow margin example. Hence with the operating cash flow ratio formula. Like the previous metric the cash flow coverage ratio is better used as a relative metric than an absolute one.

So how does the cash flow margin formula work in practice. Ad Customized Cash Flow Management Solutions From MT. A higher than industry average current ratio indicates that the company has a considerable size of short-term assets value in comparison to their short-term liabilities.

Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance sheet. The user must understand how cash flow from operations is calculated. Cash ratio is a refinement of quick ratio and.

On the trailing twelve months basis. 75 rows Cash Ratio - breakdown by industry. Ten years of annual and quarterly financial ratios and margins for analysis of Restaurant Brands QSR.

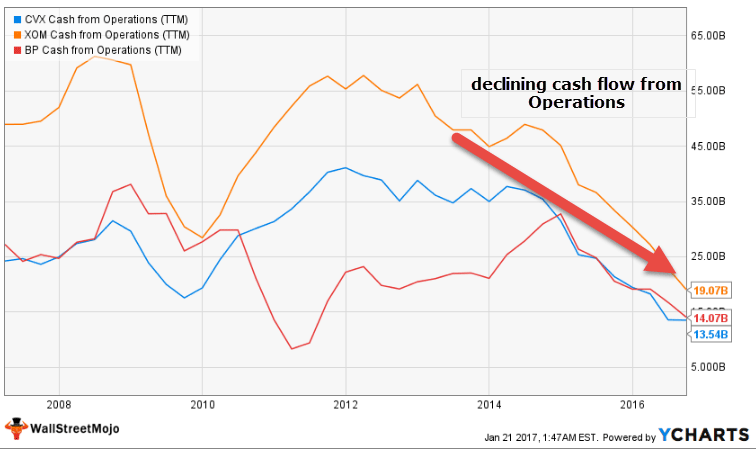

On the trailing twelve months basis Due to increase in Current Liabilities in the 2 Q 2022 Quick Ratio fell to 024 below Oil And Gas Production Industry average. This corresponds to a value of 1 or little higher than 1. The cash flow coverage ratio is calculated as.

Free Cash Flow growth YY Annual Comment. Its relatively straightforward so heres a cash flow margin example to shine a light on the practical applications. So a business with an operating margin of 20 is probably very capital efficient while one with 5 or less is pretty capital intensive.

Within Energy sector 3 other industries have achieved higher Quick Ratio. OCR Ratio Cash flow from operating activities Current liabilities 872 975 089. A nice rule of thumb shortcut would be to remember that net margin probably averages around 10 and operating margin averages around 5 more than that.

An acceptable current ratio aligns with that of the industry average or might be slightly higher than that. Since the ratio is lower than 1 it indicates that Bower Technologies has a weak financial standing or is incapable of paying off short-term liabilities at this point. Cash Flow From Operating Activities 2100000 110000 130000 55000 1300000 - 1000000 2695000.

The cash flow coverage ratio shows how much CFO a company generated compared to its total debt. Free Cash Flow growth total ranking has declined compared to a. Sequentially cumulative Free Cash Flow fell by -339.

Liquidity ratios Current ratio Quick ratio Cash ratio Operating cash flow ratio Industry Average Industry 2019-20 2020-21 2021-22 Average Revenue 49 45 37 4366666667 Employment 3 19 23 24 Wages 53 4 4 4433333333 Industry Income Statement Assumption SHL Annual Revenue change. Value Investment Funds Two 34 Year Running Average Annual Return After Quarterly. Median recommended average Financial ratio.

Operating cash flow ratio industry average Sunday July 24 2022 Edit. This ratio is used as a risk metric on a relative or empirical basis. Quick Ratio total ranking fell in contrast to the previous quarter from to 74.

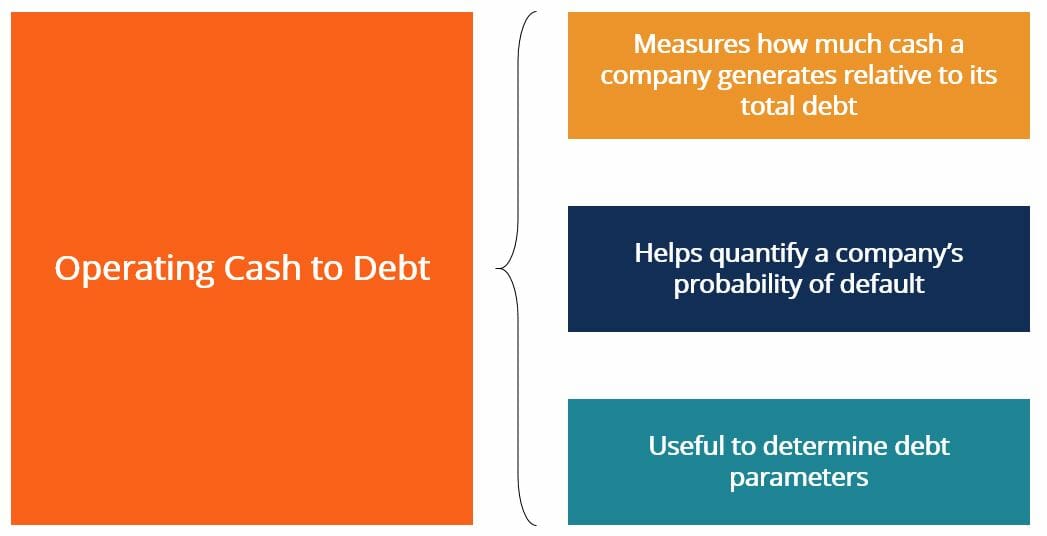

The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. Liquidity Ratio Formula And Calculation Examples Cash Flow Per Share Formula Example How To Calculate.

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Cash Flow Ratios To Analyze Cash Sufficiency Of Companies Getmoneyrich

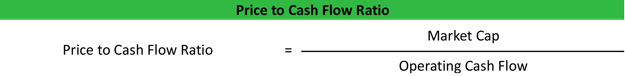

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Ratio Formula Example Calculation Analysis

Price To Cash Flow Formula Example Calculate P Cf Ratio

Liquidity Ratio Formula Calculation Example And Types Of Ratios

Cash Flow Per Share Formula Example How To Calculate

Operating Cash Flow Ratio Definition

Cash Flow To Debt Ratio Meaning Importance Calculation

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow Ratios To Analyze Cash Sufficiency Of Companies Getmoneyrich

Free Cash Flow Formula Calculator Excel Template

Price To Cash Flow Ratio Formula Example Calculation Analysis

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash Flow Formula Examples With Excel Template Calculator

Operating Cash Flow Ratio Formula Guide For Financial Analysts