child tax credit november 2021

You can also refer to Letter 6419. Most families will receive the full amount which is 3600 for each child under age six and 3000 for each child ages six to 17 in 2021.

2021 Child Tax Credit Advanced Payment Option Tas

The couple would then receive the 3300.

. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021. To reconcile advance payments on your 2021 return. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

Get your advance payments total and number of qualifying children in your online account. Enter your information on Schedule 8812 Form 1040. Right now they can only sign up online.

He advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day. The fully refundable tax credit which is usually up to 2000. After November 15th non-filer families that havent signed up yet can still claim their full Child Tax Credit during next years tax season.

It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000. Families who successfully sign-up between now and mid-November will either receive their payments distributed between November and December or in December as a lump sum. Families signing up now will normally receive half of their total Child Tax Credit on December 15.

Families can choose to file either in English or Spanish. So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per month. That drops to 3000 for each child ages six through 17.

Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. 12 2021 Published 1036 am. To do so quickly and securely visit IRSgovchildtaxcredit2021.

ET In 2021 more than 36 million American families may be eligible to receive a child tax credit. Most of the millions of Americans. For those who claimed early the IRS has been sending families half of their 2021 child tax credit as monthly payments of 300 per child under six and 250 per child between the ages of six and 17.

If Married Filing Jointly If Letter 6419 Has a Different Advance Payments Total. Thats 300 per month 3600 12 for the younger child and 250 per month 3000 12 for the older child. Those payments will last through December.

The IRS is paying 3600 total per child to parents of children up to five years of age. The enhanced child tax. The deadline is 1159 pm Eastern Time on Monday November 15.

Thats an increase from the regular child tax credit of up. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

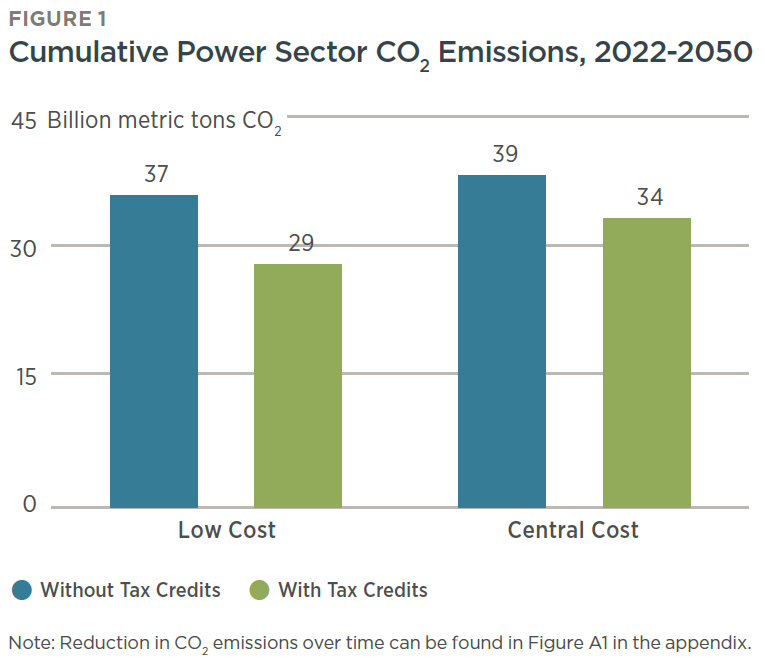

Assessing The Costs And Benefits Of Clean Electricity Tax Credits Rhodium Group

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Are Ev Tax Credits Back On The Table Maybe E E News

Child Tax Credit 2021 8 Things You Need To Know District Capital

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Explainer What Are The Child Tax Credits Democrats Are Battling Over Reuters

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Child Tax Credit 2022 Update 750 Payments Available To Americans But You Have To Apply Soon Deadline Date Revealed

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

Child Tax Credit 2021 8 Things You Need To Know District Capital

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Changes For Individuals In The American Rescue Plan Act The Cpa Journal